Streamlining Your Life: How to Simplify Your Accounts

Management Overhead

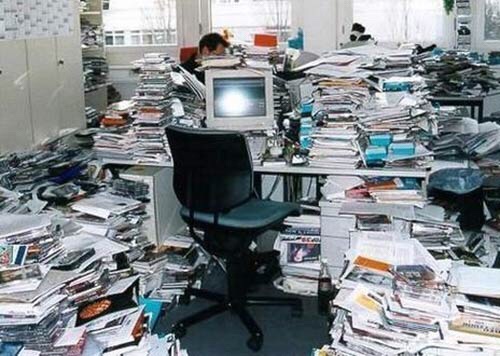

Last year, I noticed that I spent a lot of my time on managing my finances. I moved and changed jobs twice. I created Gears of Geek domain and changed my primary email address. Each time that I made these moves, I had to update my financial accounts with the new information to ensure that communication continued and that statements went to the correct address.

That got me to thinking about how much time I spend maintaining the accounts.

We often open accounts to get some type of temporary reward. It could be cash for opening an account, 0% interest balance transfer, travel points, etc. However, that account isn't free. In addition to the effort it takes to open it, you need to manage the account. There are also ongoing management tasks

- Keeping your mailing address up to date,

- Updating email address

- Downloading statements

- Reviewing transactions for fraud and for accuracy.

- Entering the account information into financial apps such as Mint or Youneedabudget (YNAB).

With this realization, I went on crusade against unused bank and credit accounts, closing anything that I did not use frequently regardless on its impact on my credit score. There are some questions that you can ask about each account to determine which one to keep.

Consolidating Financial Accounts

Savings Accounts

- Does this account have a competitive interest rate?

- Does this account have a minimum balance? Some savings accounts only offer good rates if you meet the minimum balance.

- How easy is it to access this account both online and locally?

- Is this account at the same institution as my other accounts? This makes management easier.

- Does this account have fees attached to it? Some banks make you pay them so that you can give them money to loan out. Crazy but true.

Choose the savings account with the best return and no minimum balance. If you need more than one account say, for budgeting purposes, get them at the same institution.

Checking Accounts

- Does this account have a minimum balance? There are plenty if accounts that don't require this.

- How easy is it to access this account both online and locally?

- Is this account at the same institution as my other accounts? This makes management easier.

- Does this account have fees attached to it? Some banks make you pay them so that you can give them money to loan out. Crazy but true.

Choose the checking out with the lowest fees, ideally with no fee for simply maintaining an open account. It shouldn't have a minimum balance. Don't fret over the interest rate as t his is your spending money.

Credit Cards

- Does the card have a competitive reward

- Does this card offer a cash reward?

- Is the cash reward fixed, or does it play games? Such as

- Rotating categories

- Points instead of cash

- Complicated reward structure . I.e. different rewards for different types of purchases. 1% everything, 2% Gas, etc.

- Does it have a high interest rate?

Choose the top 2 cards. You don't need more than 2.

Results

The next time that I reconciled my transactions, it went so fast that I was certain that I missed something. There wasn't much to check. Not very many emails from financial institutions, not many statements to download. It was over before I knew it.

I hope that this helped you streamline your financial accounts. I'll be sharing my techniques in future posts.